Many Tax Preparers and Advisors, and Tax Return Reviewers at do not prepare a Balance Sheet as part of Schedule L on a partnership, regular C corporation or a subchapter S corporation return because it is not required with certain thresholds promulgated by the Internal Revenue Service. This is the case even when there is a Balance Sheet available to input into the income tax return.

The States of New Jersey and California, and possibly other states, require a Balance Sheet without any regard for the threshold limitations the Internal Revenue Service has.

x

What are you looking for?

13January

Finance

ByA. Liberati

Comments0

Likes

Finance

Share this blog

11January

Finance

ByA. Liberati

Comments0

Likes

Finance

Real Estate property is classified in two categories: Residential and Non-Residential. Residential Property is depreciated over 27.50 years and non-Residential property is depreciated over 39 years. Both are depreciated on a straight-line basis and not on an accelerated basis.

There are two accelerated methods of expensing depreciation that the Internal Revenue Service provides – bonus depreciation and section 179 expensing. These accelerated depreciation methods are NOT available for real estate property operated as part of a trade or business.

Share this blog

13December

Finance

ByA. Liberati

Comments0

Likes

Finance

So, you want to start a business where you are in control to provide those engineering services that you have been offering to your employer for 20 years.

Share this blog

25November

Tax

ByA. Liberati

Comments0

Likes

Tax

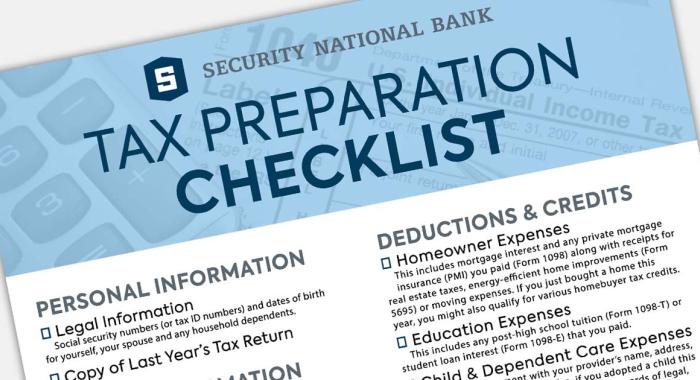

Are you looking forward to just drop all paperwork that you can find for 2022 to your Tax Preparer for the 2023 Tax Filing Season?

Share this blog

3November

Finance

ByA. Liberati

Comments0

Likes

Finance

Regular C corporations can own subsidiaries, either wholly or partially.What about subchapter S corporations?

Can a subchapter S corporation own a subsidiary?The answer is Yes.

The subsidiary is known as a Qualified Subchapter S Corporation subsidiary, or a Qsub for short, after it obtains its own subchapter S corporation status.A Qualified Subchapter S Corporation subsidiary can be merged into its subchapter S corporation parent. The parent must own 100.00% of the qualified subchapter S corporation subsidiary.

Share this blog

20September

Finance

ByFarrington R.

Comments0

Likes

Finance

Investors in digital assets like cryptocurrency and non-fungible tokens (NFTs) have been on a wild ride these last few years.

Share this blog

20September

Finance

ByGupta V.

Comments0

Likes

Finance

Here's a list of the World's richest entrepreneurs in 2022. Still not convinced if entrepreneurship is worth it? Then, this post will change your perspective. Get inspired by the success stories of these amazing entrepreneurs. They've changed the world. Now, it's your turn.

An entrepreneur is a person who sets up a business or an organization by taking a financial risk.

Share this blog

20September

Payroll

ByWeltman B.

Comments0

Likes

Payroll

If you want to grow your business, you probably need to hire employees to help you.

If you want to grow your business, you probably need to hire employees to help you. Becoming an employer and expanding your staff entails many responsibilities, one of which is seeing to payroll taxes. Unfortunately, there are many myths about these taxes. Here is the reality:

1. Myth: Transforming employees into independent contractors to save on payroll taxes is easy

Share this blog

12September

Bookkeeping

BySBBC

Comments0

Likes

Bookkeeping

Unless you are an accountant or a fan of working with numbers, bookkeeping is probably not your favourite task. But adopting some good habits early can help you avoid costly errors when it comes to record keeping. That’s why we’ve put together these five bookkeeping tips for small business.

Share this blog

1September

Finance

ByJ. Camberato

Comments0

Likes

Finance

When the Covid-19 pandemic began, and businesses were forced to shut down their operations, Congress passed programs to provide financial assistance to companies.

Share this blog